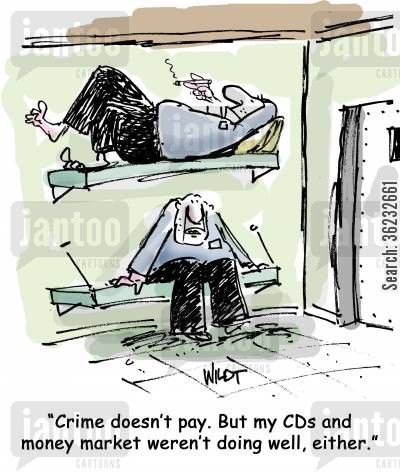

MAIN STREET — Every insurance agent has a unique career path that either leads to success, moderate achievement or, at worst, a long stretch in the hoosegow. Agent’s early careers are full of long, hard hours with the flames of uncertainty licking their heels.

Most agents assess the challenges as they arise, and either endeavor to perceiver or move on to less challenging careers.

Some however decide to take a different path to easy money, often with disastrous results.

But agents are not the only ones seeking a quick financial hit. Your man and woman on the street are always looking for an easy way down the road and insurance fraud is one avenue. It’s hard to say just how many successful fraudulent insurance activities go undetected, but when they are exposed the industry has little compassion for such bad behavior.

What follows shows three instances where, agents, citizens or industry high rollers go bad.

Virginia man gets caught in insurance scam

PORTSMOUTH, Va. — A Suffolk man was sentenced to two years in prison after pleading guilty to obtaining money by collecting insurance premiums from a Portsmouth woman and keeping the cash.

For nearly a decade, Joseph E. Barnes collected $30.95 every month from Anita Hawkins in Portsmouth for a term life policy. The agreement was an older-style industrial policy that is sold by an agent who goes door-to-door.

Hawkins called Columbian Mutual Life with a question about her policy and was told there was no policy in her name.

The State Corporation Commission's Bureau of Insurance and state police Insurance Fraud Program investigated the case.

Barnes had not worked for the insurance company since 2009, but continued to collect payments from Hawkins.

The company returned the payments to Hawkins and Barnes began paying restitution to Columbian. He also surrendered his insurance license.

Zombie insurance

JACKSONVILLE, Fla. — Federal officials arrested a Florida businessman and his wife in a multimillion-dollar case of the living dead insurance fraud case in Florida.

Jose Lantigua, who owned Circle K Furniture before he was reported dead in Venezuela in 2013, was charged Tuesday with passport fraud and aggravated identity theft.

His wife, Daphne Simpson, was charged with making a false statement to officers by telling police Lantigua was a friend, rather than her husband, when agents approached a Jeep the couple was travelling in.

The separate indictments could mean that the couple would stand trial years apart in Jacksonville on identical charges stemming from $9 million worth of life insurance claims filed over Lantiugua's supposed death.

Simpson, 57, is being held on eight felony charges of insurance fraud and schemes to defraud, having been arrested hours after she drove home following Lantigua's arrest. She could face up to five years in federal prison.

Simpson's state-level charges will be handled independently of the federal case.

Lantigua's identity-theft charge carries a mandatory minimum two-year prison sentence in addition to any sentence from the passport charge, which could carry a ten-year sentence.

LA firm accused of $100M Life Settlement Scam

WASHINGTON — A Los Angeles-based life settlement broker is being cited by the Securities and Exchange Commission for alleged fraud in the sale of life settlements.

The SEC is seeking an injunction against Beverly Hills-based Pacific West Capital Group and its owner, Andrew B. Calhoun IV.

Pacific West is not registered with the SEC. The complaint also seeks to recover fraudulent gains and civil penalties.

The SEC charged that that since 2004, Pacific West and Calhoun have raised nearly $100 million from life-settlement investors.

Since at least 2012, Pacific West and Calhoun allegedly defrauded investors by using proceeds from the sale of new life settlements to continue funding life settlement investments sold years earlier, the complaint said.

According to the SEC’s complaint, Pacific West and Calhoun made false and misleading statements about the risks of investing in life settlements, including the risk of investors having to make increased premium payments as insured individuals lived longer than Pacific West and Calhoun anticipated.

“Investors are entitled to fair disclosures about the risks associated with their investments,” said the director of the SEC’s Los Angeles Regional Office.

“We allege that Pacific West and Calhoun did the opposite here by hiding and minimizing those risks in order to sell more life settlements.”

And the moral of these stories . . .? Crime does pay, but only if you don’t get caught.